West Cork delegation puts it up to the Finance chief

A GROUP of West Cork restaurateurs and café owners met with Minister for Finance Michael McGrath last Friday in what has been described as ‘crunch talks’ prior to Budget 2025.

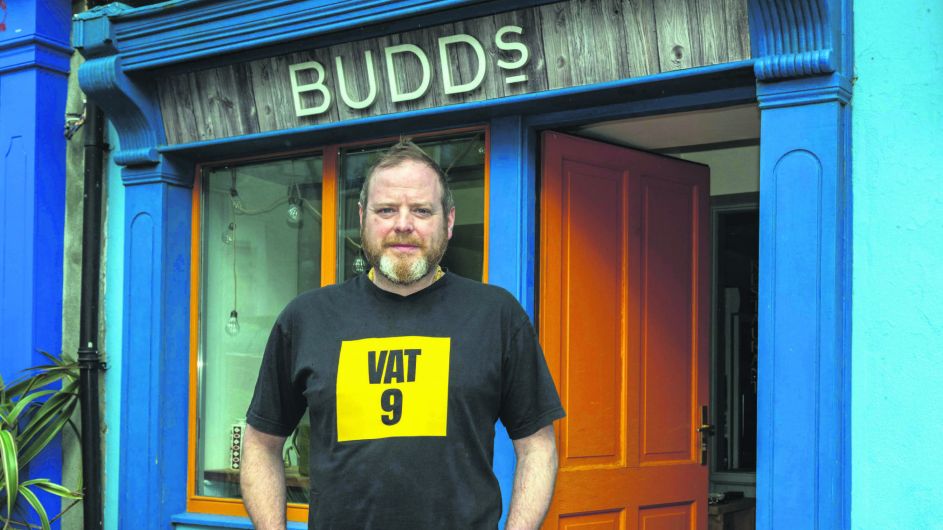

The group, members of which run independently-owned cafés and restaurants, launched a national campaign in April called ‘Vat9 Now’ in a bid to get the lower 9% vat rate reintroduced for the hospitality sector.

The vat rate returned to 13.5% for the hospitality and tourism industry in September 2023, after being reduced to 9% in November 2020, as part of government aid to the sector in the pandemic.

But owners say that spiralling energy costs, combined with food and minimum wage increases, and already tight margins, are all making their businesses almost unviable.

Jamie Budd of Budd’s restaurant in Ballydehob, who has helped spearhead the drive, said the meeting went ‘really well. We were surprised that Minister McGrath met us in person, and that was very encouraging as he’s the one in charge of the purse strings, and who will make the decision,’ said Jamie.

‘It was really important that we were able to share the reality of our situations with him directly as I’m not sure that those in government fully appreciate the struggle that it’s become.

‘We need him to know that we’re not naive first-timers who are running businesses, but that we’re people with proven track records who know what they’re doing, who run busy restaurants, most of them “go-to” destinations, who have already diversified, and that despite all of that, we’re still struggling,’ he added.

TD Christopher O'Sullivan, far left, and Minister Michael McGrath, centre, with, from left: Gavin Moore, Monks Lane Timoleague; Forbes Kelly and Aisling O'Leary and baby Néala of Revel, Clonakilty; Peter Shanahan, Fish Basket Long Strand; Chris Fahey, Wildflour Bakery Innishannon; Barry McLaughlin, Poacher's Inn Bandon; Liam O'Leary, Wazzy Woo, Clonakilty and Andrew Loane, Oak Fire Pizza.

TD Christopher O'Sullivan, far left, and Minister Michael McGrath, centre, with, from left: Gavin Moore, Monks Lane Timoleague; Forbes Kelly and Aisling O'Leary and baby Néala of Revel, Clonakilty; Peter Shanahan, Fish Basket Long Strand; Chris Fahey, Wildflour Bakery Innishannon; Barry McLaughlin, Poacher's Inn Bandon; Liam O'Leary, Wazzy Woo, Clonakilty and Andrew Loane, Oak Fire Pizza.

Minister McGrath didn’t make any guarantees, he said. ‘We didn’t expect him to. We’re glad he heard our accounts, and we aren’t going away.’

Cork South West Deputy Christopher O’Sullivan arranged the meeting and described it as ‘very engaging and positive’.

‘My hat goes off to the incredible business owners who have given up their time to fight for a reduction on the vat rate from 13.5% to 9%. I applaud them for their honesty and bravery in sharing their experiences and the struggles they face in keeping their business afloat on a day-to-day basis,’ said the deputy.

He said it was ‘highly unusual’ that Minister McGrath would meet such a delegation.

‘Of course, the minister couldn’t make any promises on the day. However, I am satisfied that he listened to the concerns and heard the reality on the ground for some of the most important hospitality businesses in West Cork.’

‘With a wave of increased costs, including increase in minimum wage, increase in energy costs, increase in the pension auto enrolment, we have to release the pressure somewhere. Reducing the vat rate is one of the areas where the government can help,’ he said.

Meanwhile Independent Ireland leader and Cork South-West TD Michael Collins called on the Government to reduce Vat even further in areas outside Dublin ‘to promote regional balance’ by cutting it to 5%.