‘Financial advice has changed dramatically over the years. People are far more financially aware nowadays, with most financially astute people retaining the services of a financial adviser. ‘ says Director Dan Murphy, who along with fellow director Kieran Hurley, founded ODM Financial Advisors in 2006.

Today, the two directors lead a team that includes five more back-up staff in their offices at Bank Place, Bandon.

Back in 2006, pension contributions were driven by tax savings, however there is so much more to the function of a financial adviser with 55% of people surveyed feel more in control of their finances having used a financial adviser.

‘The industry is highly regulated by the Central Bank of Ireland’ says Dan. ‘and at the cornerstone of any advice you give is a holistic view of the client and their needs, you need to have an overall appreciation of the client and their circumstances.

‘Financial advice and financial planning go hand in hand so therefore it is not alone an assessment of their current circumstances, but it’s also knowing where they are, where they want to go and how they’d like to get there.’

It might sound highbrow but it is very simple with the process beginning with the client filling out a financial planning questionnaire, which leads to an initial discussion to get an appreciation of the client’s circumstances.

‘Once you have an idea of where the client is presently and where they would like to go, we then put in place a ‘roadmap/financial plan for the client. The process is the same but every plan is bespoke.

‘People who began as clients of ours in their 30s and 40s and who are now in their 50s and 60s are seeing their plans bear fruit as a result of our advice,’ says Dan, who points out that their work is with people at all different levels and stages, whether it’s planning for retirement or postretirement options or those putting together a plan to have money in place for when their children go to college.

‘Or there are also those who might have been successful through their lifetime and who have some inheritance and succession plans that they need to have in place.’

Our Voyant software is a further recent development says Director Kieran Hurley.

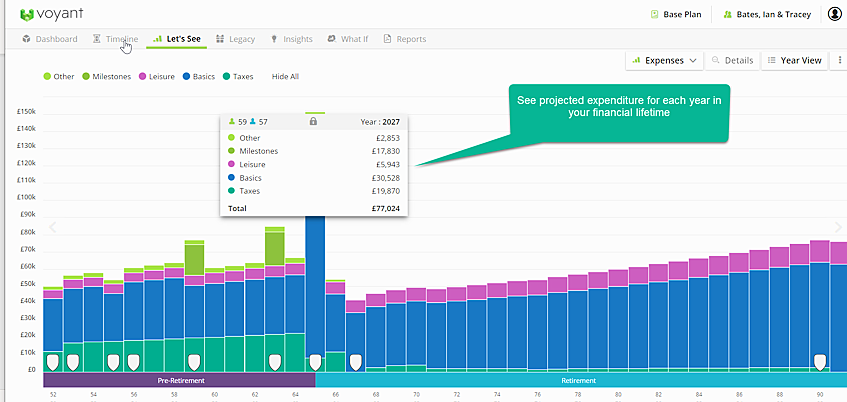

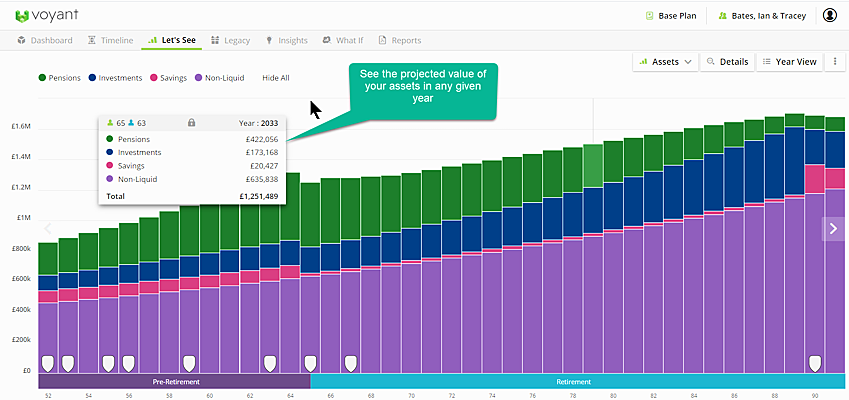

Quite simply, it is ‘monies in / monies out’ – what money do we have coming in now and what are we spending now – and, most importantly, what do we EXPECT to have coming in compared to what we EXPECT to spend in the future?

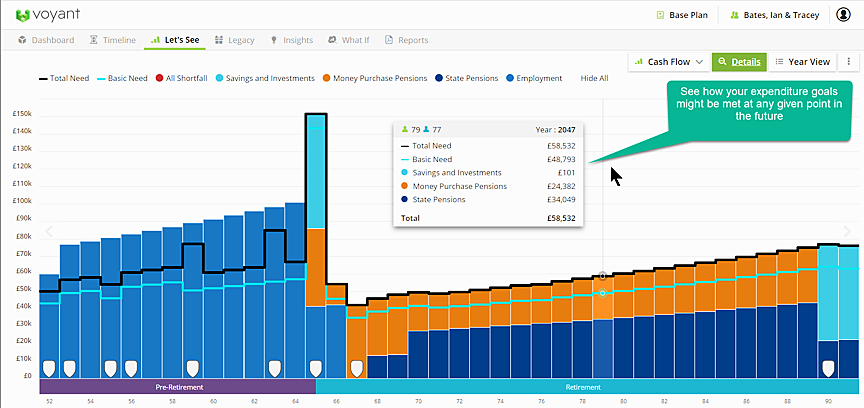

The cash flow chart in Voyant analyses current and projected future needs goals and aspirations and assesses the likelihood of being able to achieve them, year on year, throughout your lifetime(s).

It puts forward various ‘What-if?’ scenarios, answering all of the common questions that people have:

• Can I really retire at 60? Would my family be okay if something were to happen to me?

• Could we possible afford to buy a holiday home?

• Can we afford to change our car every three years?

• How much do I need to sell my business for?

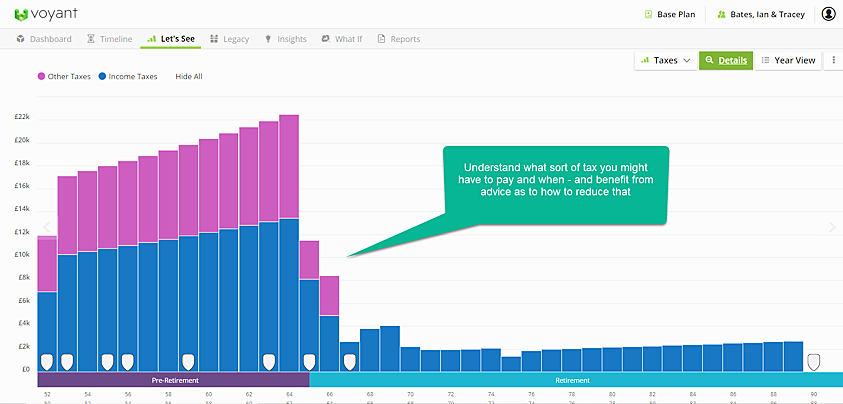

• How much tax will it incur?

• How can I help my children financially?

• What can I do with an old employer pension plan?

• How can I ensure to not run out of money?

‘We can provide a lot of the answers to those questions,’ says Kieran.

‘Prudent financial advice can help lay the foundations for future financial stability and ultimately provide the desired financial freedom over the course of time. Increasingly, fewer people have the time or expertise to successfully manage their personal finances in a holistic manner, particularly as their financial circumstances become more demanding and complicated.’

‘We have been doing this for our West Cork clients for over 30 years and have seen them gain from the benefit of using a financial adviser.

‘For example, the average pension pot is valued at €128,933 for those who use financial advice and €62,600 for those who do not. This represents a 105% difference in those who have used financial advice as per a Brokers Ireland 2021 survey. Based on the same survey and research it is evident that those who receive financial advice are more likely to achieve greater personal financial benefit through guidance in pensions, saving/investment and protection services by comparison to those who don’t receive financial advice.'

The lesson is: impartial financial planning and advice is a must.

Contact Dan at [email protected] or Kieran at khurley @odmfinancial.ie or feel free to call 023 8842700 to book a no-charge consultation.

Dan Murphy QFA Director

Dan Murphy QFA Director

Kieran Hurley Director QFA RPA PTP (Pension Trustee Practitioner)

Kieran Hurley Director QFA RPA PTP (Pension Trustee Practitioner)