THE core of what a financial planner deals with is the question ‘will we be okay?.

There is a lot wrapped up in this, but what it boils down to is whether people have enough to achieve their life’s goals, dreams and ambitions.

During the working years we use our brains and brawn to bring income into the household, this ability to earn income is referred to as human capital.

But as we get older our human capital diminishes and at some point, we will need to draw income from our financial capital, i.e. our accumulated savings, investments and assets.

But how much is enough, and what can we do affect this?

How much is enough?

For many it can be difficult to understand the level of income needed to achieve a certain standard of living, and subsequently to build a sufficient savings and retirement plan to fund lifestyle.

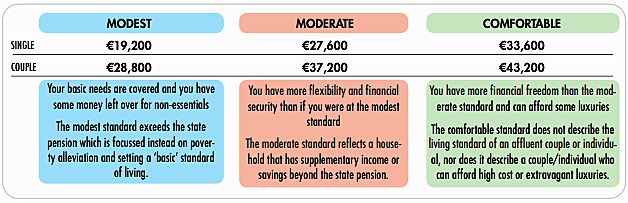

The Pensions Council commissioned a report ‘Irish Retirement Living Standards’ to help guide people to be more financially prepared for retirement developing three annual expenditure levels.

Are these income levels achievable? In short, yes!

But the State Pension (Contributory) alone will not get you there.

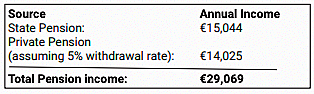

The maximum State Pension of €289.30 per week, gives a yearly income of €15,044 hitting almost 80% of the modest income requirements, 55% from moderate and 45% for comfortable.

How can I improve my income level when I stop working?

Workers can improve on this by using what is in my opinion the best most tax efficient savings plan in the country, the humble pension.

This becomes even more powerful where it is a workplace pension that offers an employer contribution.

Jane, a 35-year-old earning the average industrial wage and aiming to retire at 66.

According to the Central Statistics Office this was €50,394 in the first quarter of 2024.

Jane contributes 5% of her earnings to her workplace pension, with the employer matching this.

If the pension savings achieve an assumed rate of investment return of 5%, Jane will have an assumed pension pot of €374,000 at 66 providing a tax-free lump sum of €93,500.

But what pension income will this give Jane?

The levels described are guidelines, it is important to bear in mind that the terms “modest”, “moderate” and “comfortable” are subjective and have been developed to reflect national averages.

Adrian White is a Financial Planner with FDC Financial Services within the West Cork Region.

Adrian White is a Financial Planner with FDC Financial Services within the West Cork Region.

The correct income level is individual to each person and family.

Personal financial planning can establish what comfortable means to you and help to get you there.

The value of advice for this cannot be underestimated, with a report commissioned by Brokers Ireland in 2021 titled ‘Value of Advice’, highlighting that the average pension pot for those using financial advice is 105% greater than those that do not use financial advice, with the value of savings and investments being 53% higher amongst respondents that had used financial advice.

Take control of your finances today to provide for a brighter tomorrow.

Warning: Past performance is not a reliable guide to future performance.

Warning: The value of your investment may go down as well as up.

FDC Financial Services Ltd is regulated by the Central Bank of Ireland.