The SUSI grant application system will open to new applications from mid-day the 3rd of April 2025.

Renewal applicants have received reminders and have been invited to complete their applications.

The good news in relation to student grant applications this year is the income limits have increased in each income band.

Maintenance grant is a contribution towards day-to-day living costs, the grant is paid directly to eligible students through nine monthly instalments over the course of the academic year.

You can make a new application (after the 3/04/25) or renew your grant by logging onto Student Universal Support Ireland website (www.susi.ie).

If you did not receive a student grant from SUSI in the 2024/25 academic year, you can make a new grant application if you meet the criteria this year.

Students should submit their applications as early as possible.

You will need your personal public service number and an email address and phone number to apply online.

There is an application tracker in the online system to check the progress of applications at any stage.

To facilitate in the completion of the grant form, the following information will be required:

• your CAO or UCAS number (if you have one),

• PPSN numbers for yourself, your parent(s)/legal guardian(s), spouse, civil partner or cohabitant, as applicable,

• income details for 2024 for yourself (if any), your parent(s)/legal guardian(s), spouse, civil partner or cohabitant, as applicable.

The application form comprises the following six sections:

• Section A – personal details (of applicant),

• Section B – nationality & residency (of applicant),

• Section C – course details, previous education, and other sources of financial support (of applicant),

• Section D – personal details (of parent(s)/legal guardian(s), spouse, civil partner, or cohabitant, as applicable),

• Section E – dependent children and relevant persons (of the household),

• Section F – income (of applicant, parent(s)/legal guardian(s), spouse, civil partner, or cohabitant, as applicable).

The following information is required when calculating your reckonable income:

• Gross income earned in 2024, including any benefits-in-kind, from all Irish and foreign employments.

• Social welfare income other than child benefit.

• Self-employment income(losses), including farming income (losses) earned at any time during 2024, (There are adjustments for capital interest paid, family wages etc.)

• All rental income earned (after allowable expenses).

• The gross amount of all interest or income earned from savings, deposit accounts and personal loans made by you and any investments (stocks, shares, bonds, securities and dividends) in 2024.

• Income from maintenance payments.

• Lump sum payment received during 2024 from retirement or redundancy.

• Income from disposal of assets and rights.

• Gifts or inheritances.

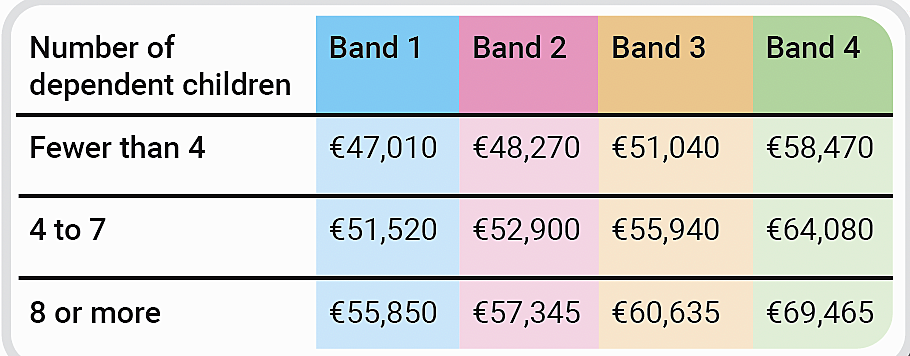

The reckonable income limits are increased to take account of the number of dependent children.

The limit can also be adjusted depending on the number of persons within the household who are attending a full-time course of study in further or higher education, in accordance with the Student Grant Scheme.

Income limits for maintenance grant and full fee grant.

The family income limits for eligibility for a maintenance grant in 2025-2026 are set out below.

These income limits are applied after your means are assessed.

Maintenance grants amounts can vary depending on the distance from the college over 30kms and under 30kms.

The income limits are increased depending on the number of full-time college students in the household.

If a student worked and studied in the last year, SUSI can deduct a portion of the income earned outside of term time, the maximum deduction is €8,424.

This is called holiday earnings and applies to income earned during Easter, Summer and Christmas holidays.

It is difficult to cover every aspect of the SUSI grant system, the website is very helpful and user friendly, it is recommended to refer to the website in relation to your own individual circumstances and for more detailed information.

If you have any queries regarding any of the above, please do not hesitate to contact me or any of my colleagues in FDC.

Ann Marie Hurley, Patrick’s Quay, Bandon, Co Cork. 023 8841744, [email protected].

FDC Financial Services Ltd is regulated by the Central Bank of Ireland