AS a nation, we are living far longer than previously, but it also leads to the possibility of needing long term care needs, and this is becoming a far more common aspect of our daily lives.

To assist with the cost of this care – the Fair Deal Scheme is available.

In FDC Group, we are experiencing much more conversations around the Fair Deal scheme implications in terms of planning for this eventuality should the need occur, so we will here give a summary of this scheme.

What do you need to know when applying for the Fair Deal Scheme?

The ‘Fair Deal Scheme’, brought into law in 2009 which is managed by the Health Service Executive (HSE) is a scheme providing financial support to people who need long-term nursing home care.

Under the Fair Deal scheme, you pay a determined amount towards the cost of your care and then the HSE pays the balance.

Approved public nursing homes, private nursing homes and voluntary nursing homes are covered by the scheme.

This scheme is specifically for long-term care as opposed to short-term care such as respite and convalescence.

The primary purpose of the ‘Fair Deal Scheme’ is to allow families the opportunity to access nursing home care and to share the cost of this care with the Government.

How Fair Deal works

If you’re approved for Fair Deal, you pay a certain amount towards the total cost of nursing home care and HSE pays the balance.

Your payment is a fixed amount. It will be the same for any approved nursing home, no matter how much it charges.

While you wait for funding you can choose to pay privately for care.

Fair Deal funding cannot be backdated and will only be paid from the date it is approved.

Not covered by Fair Deal

The Fair Deal scheme does not cover: short-term care such as respite, convalescent or day-care or extra fees charged by the nursing home for services like hairdressing, therapies or activities Ask your nursing home what extra fees will need to be paid.

These will be included in your contract with the nursing home.

How Do You Apply?

There are 4 steps to the Fair Deal application process:

Step 1 Fill in the application form

Step 2 Complete a Care Needs Assessment

Step 3 Complete a Financial Assessment

Step 4 Apply for a Nursing Home Loan (this step is optional)

3-Year Cap

This is a limit on how much you pay towards nursing home care as part of the scheme.

It’s based on the value of certain assets – your home, proceeds from sale of home, your farm or business.

Cap: You contribute 7.5% of the value of these assets for a maximum of 3 years. Note – you must apply for your farm/business to be included in 3-Year Cap.

1. Completing the application Form

The first step is completing the Nursing Home Support Scheme Application Form.

The form should be completed and signed by either the person looking to receive nursing home care or by a specified person on their behalf (see section How to apply on behalf of someone else in Citizen Information link).

The completed form along with the necessary documents should then be sent to your ‘local nursing homes support office’.

A full list of documents you need to send can be found on page 15 of the Fair Deal nursing home support application form (PDF, 16 pages, 1.78MB))

The HSE will let you know once the application is received.

2. Care Needs Assessment

The HSE will arrange the care needs assessment to identify if long-term nursing home care is appropriate for you.

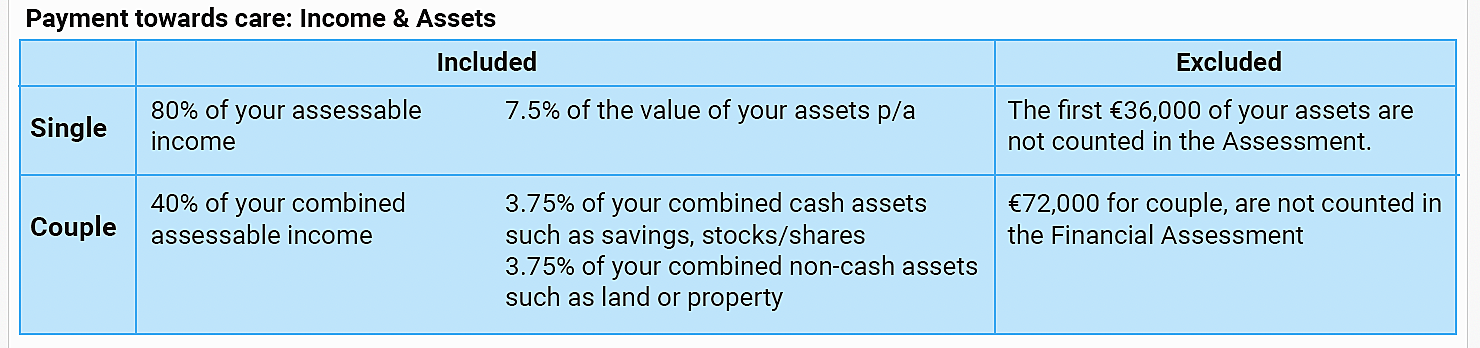

3. Financial Assessment

The financial assessment determines how much you can pay towards a nursing home.

Your income and assets are examined through this assessment. For couples, the assessment will be based on half one’s income and assets.

To conclude, it is important to discuss the future potential implications of the cost of long-term care if required with your Financial Planner/Accountant as each individual situation is unique.

It is often mis-understood also that all of your assets will be taken from you in the event of the need for long-term care of which is not the case, and hence the discussions about your personal set of circumstances will assist you in understanding your position.

Seamus O’Mahony is a Financial Planner with FDC Group in the West Cork Region.

FDC Financial Services Ltd is regulated by the Central Bank of Ireland.