THE selling prices of properties in Cork county shot up by nearly 3% in the second half of last year.

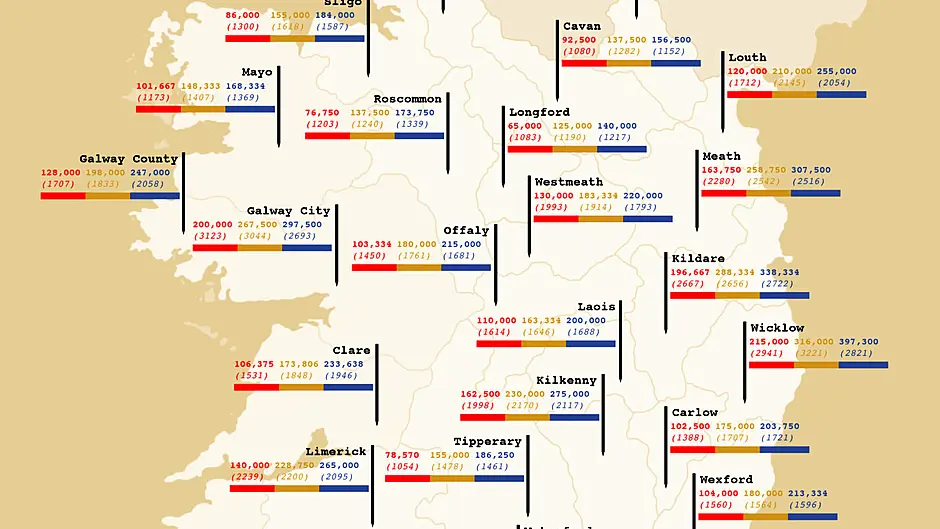

That’s according to the latest Residential Property Price Barometer which charts average prices achieved by auctioneers in the last six months of 2019 for the three bestselling property types: three and four-bedroom semi-detached houses and two-bedroom apartments.

For the period from January to June last, a two-bed apartment in Cork county made €125,000. But that figure went up 3.85% to €130,000 in the second half of the year.

A three-bed semi here was typically selling for €207,143 in the first half of the year, and going for €215,000 in the second half. That represented a hike of 3.65%.

And a four-bed semi went from €247,572 to €250,715 – up 1.25%.

In fact Cork county was one of just three counties to out-perform in terms of house inflation in the three-bed semi sector; along with Longford and Westmeath.

But, according to Pat Davitt, chief executive of the Institute of Professional Auctioneers and Valuers, the statistics reflected a ‘disappointing enough back end to the year, but positive signs are emerging for 2020.’

‘The property market is still mired in difficulty, however. According to the CSO the number of people in Ireland over the past five years has increased seven times more than the number of dwellings. Young people who would normally be buying their own homes are being forced to find alternatives, including living at home for longer. More households are competing for fewer available homes,’ he said.

Mr Davitt said there was little doubt that Brexit ‘had a negative impact on property prices throughout 2019’ but said the mood lifted towards the end of the year.

‘It would appear that Brexit uncertainty has abated somewhat and more people are looking at purchasing property according to our members,’ he added.

In total, some 55,000 sales were recorded on the Property Price Register for 2019, which was a drop of 2,239 compared to 2018.

‘One of the reasons for that drop may be people on average wages being forced into the rental market because they cannot acquire credit for homes on which it would be much cheaper to pay a mortgage than a rent.

‘This is impacting on them now but the longer it prevails the more precarious it will become for them in terms of their financial wellbeing in later life,’ Mr Davitt stated.

Donal Buckley, who analysed the figures for the IPAV, reported that Wicklow, a commuter county, saw the strongest price growth across all three house types, in the entire country.

Subscribe to the Southern Star's YouTube channel, like us on Facebook and follow us on Twitter and Instagram for all the latest news and sport from West Cork.