ILLNESS Benefit is a weekly payment that you may get if you cannot work because you are sick or ill.

To get Illness Benefit, you must meet the social insurance (PRSI) conditions

You should always apply for Illness Benefit if you are medically certified as unfit for work. Even if you don’t qualify for the weekly payment, you may get PRSI credited contributions which can help you qualify for future social welfare payments.

If you don’t qualify for Illness Benefit or while you are waiting for a decision on your claim for Illness Benefit, you may get a Supplementary Welfare Allowance.

You should apply for Illness Benefit while you are out sick from work, whether your employer pays you or not. Illness Benefit is not linked to your employer’s policy on pay for sick leave. However, if you get sick pay from work and Illness Benefit, you should ask your employer about any arrangements in place for this.

How does the Statutory Sick Pay link with Illness Benefit?

Statutory Sick Pay (SSP) is paid for 5 days a year. You cannot get Illness Benefit on the days that you get SSP. If your illness is less than 5 days and you qualify for Statutory Sick Pay, you don’t need to apply for Illness Benefit. For illnesses lasting more than 5 days, Illness Benefit starts from day 6.

If you use your 5 days of SSP and you become ill again in the same year, you’ll get Illness Benefit from day 4 of your illness, which is after the normal 3 waiting days.

How to qualify for Illness Benefit

To qualify for Illness Benefit, you must be under pension age, be medically certified as unfit for work by a medical doctor (GP), have enough social insurance (PRSI) contributions, and apply within 6 weeks of becoming ill.

There is no payment for the first 3 days of illness. These are known as ‘waiting days’ (Sunday is not counted as a waiting day.) There are no waiting days if you were getting certain other social welfare payments within 3 days of the start of your illness.

You should speak with you local Citizens Information Centre for more information on the qualifying conditions and how they apply to your situation.

Only PRSI contributions paid at class A, E, H and P count towards Illness Benefit. Class S PRSI, paid by self-employed people, is not a qualifying social insurance class.

Illness Benefit is paid for a maximum of 2 years (624 payment days) if you have at least 260 weeks of social insurance contributions paid since you first started work or 1 year (312 payment days) if you have between 104 and 259 weeks of social insurance contributions paid since you first started work

What happens when my entitlement expires, and I am still unable to return to work?

Before your payment is due to stop, you will be contacted by the Department of Social Protection (DSP) telling you when your payment will stop and giving you information on your options, for example:

• If you are ill and likely to be permanently incapable of work and satisfy the PRSI conditions, you may get Invalidity Pension

• If you do not get Invalidity Pension and you have a disability that is expected to last for a year or more, you may get a Disability Allowance

• If you do not qualify for any other payments and your income is too low to meet your needs, you may get a Supplementary Welfare Allowance

You cannot work while you are getting Illness Benefit.

If you are getting Illness Benefit for at least 6 months, you can apply for Partial Capacity Benefit (PCB). The PCB scheme allows you to return to work and continue to get a social welfare payment, if you have a reduced capacity to work.

A Medical Assessor (a doctor employed by the Department of Social Protection) will assess the restriction on your capacity for work.

The rate of PCB paid is based on this assessment. You cannot start work until you have written approval from the DSP.

You must get written approval from the Illness Benefit section of the DSP before you start any training or educational course or voluntary work.

How much Illness Benefit will I get?

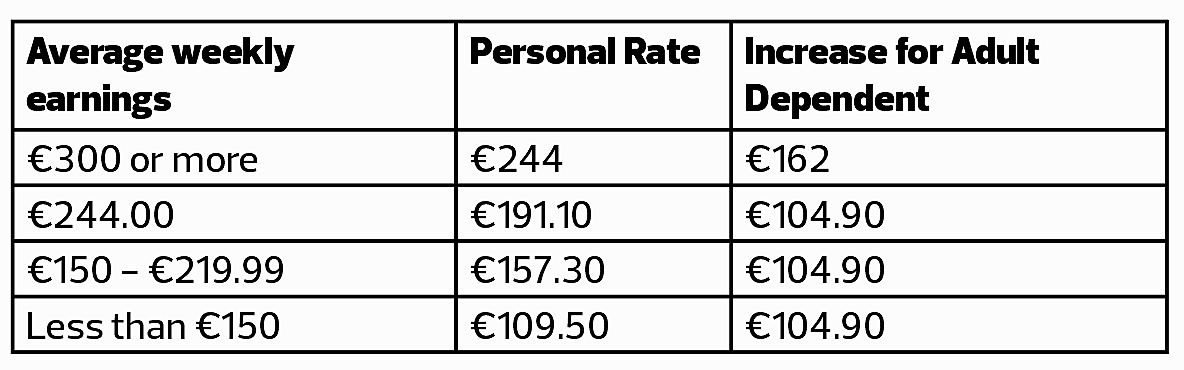

Your weekly rate of Illness Benefit (IB) will depend on your average weekly earnings in the relevant tax year.

You should apply for Illness Benefit online at

MyWelfare.ie if you have a verified or basic MyGovID account, and a medical certificate from your

GP.

If your GP completed the medical certificate online, you will get a copy of the certificate for your records.

If your GP cannot complete the medical certificate online, you can get the certificate from your GP and post it to Freepost,

Social Welfare Services, P.O. Box 1650, Dublin 1.

Alternatively, you can complete a paper Illness Benefit application form and a medical certificate called a ‘Certificate of incapacity for work’ from your family doctor (GP). You fill in the IB1 form and freepost it to the Department of Social Protection.

Your GP can provide one medical certificate to cover the duration of your illness. Some GPs can complete the medical certificate online. If your GP cannot send it online, you will get a paper medical certificate which you must fill in with your personal details and freepost it with your IB1 form to the Department.

If you think you have been wrongly refused Illness Benefit, you can appeal the decision to the Social Welfare Appeals Office. You should appeal within 21 days of getting the decision.