BY SEAMUS O’MAHONY

LAST week we had Budget 2022 delivered, as autumn arrived, ending what had been a pleasant spell of dry weather, with days now shortening and less daylight coming from both ends of the day.

That said, Budget 2022 has been endorsed by many, and it has been a favourable year for farming and the agricultural sector for the most part.

There are always headwinds that bring with them uncertainty, but farmers have always been resilient to change, and it is important to keep a balanced view for the future, despite the lack of clarity.

The CSO, in its recent publication, outlines the final estimate of agricultural operating surplus for 2020 which shows an annual increase of €337.9m (+11.6%), up from €2,924.8m in 2019 to €3,262.8m.

This increase is in line with the trends shown by other CSO short-term indicators in agriculture. The value of agricultural output at basic prices rose by €391.8m (+4.6%), with cattle and pigs accounting for €146.6m and €58.9m of this growth, respectively.

The growth of the sector has been key to rural Ireland and the spin-off industries that benefit from same. We have seen many farm enterprises transition to farm companies over recent years, and indeed this is evident across the entire country, and across all sectors.

Recent statistics outline a 42% increase in new company registrations during the first half of 2021, as opposed to 2020.

While there are some inherent reasons for a dip in such figures in 2020, this is staggering – almost 14,000 new limited companies formed in the initial six months of the year.

There has been a wide range of sectors included in such formations, but the geographical spread of same is also encouraging, with counties like Sligo, Westmeath and Monaghan seeing the greatest percentage growth.

Positive exchequer figures in recent quarters have undoubtedly made life easier for those framing the budget policy of late. It is encouraging to see some of the most impacted sectors recover year-on-year to the end of Quarter 2 2021.

However, agriculture has indeed held a very strong consistent return to the economy throughout.

The performance of the Irish economy has been a real success story from a European and indeed global context, and it is anticipated it will continue this positive trajectory into the remainder of 2021, and indeed 2022, according to leading indicators.

Needless to say, there are real issues of concern, with energy prices soaring in recent weeks, along with supply issues across the globe, leading to inflationary concerns.

While there are various inflation figures voiced from 2.8% upwards, some of the reasoning for same is attributable to the pent-up demand that has been created from the easing of restrictions across the globe.

As a result, some indicators are predicting that such inflationary pressure will subside in the months ahead and restore itself to a more realistic 2.3% in 2022.

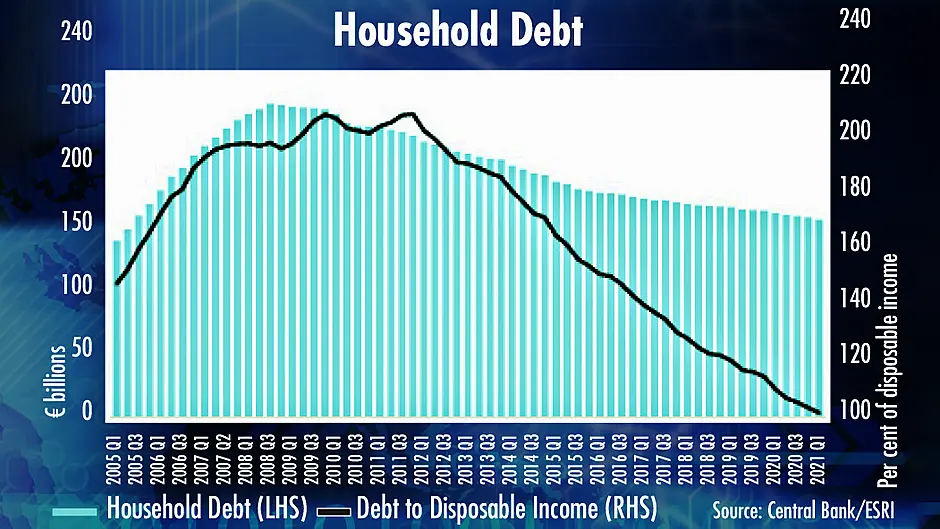

It is also very encouraging to see household debt reduce steadily since the peak of 2007 as evident in the bar chart at the bottom of the page, with the figure now standing at €128bn.

It is also represented in the graph, as 102% of disposable income, which has fallen even at a sharper rate over the same period of time.

In conclusion, there has been much evidence in recent publications of the state of the nation, and where there are always so many different methods of interpreting this data, it is probably safe to say that, as a small open economy, we have performed incredibly well against the challenges posed to all sectors.

While there will always be uncertainty, we should face it with optimism given the complexities of recent times.

• Seamus O’Mahony is financial consultant with FDC Financial Services Ltd.